My last article provoked a lot of feedback. It was about the way individuals who have created an exceptional amount of wealth view risk.

I have often said that my role in helping people with their wealth is mostly about risk management. Finding the appropriate balance between risk and reward is arguably the most important thing I can do for them.

But I find that people often have a narrow or flawed view of what risk is. Many people think of it only as the possibility that they will suffer a permanent loss. For example, if they were to invest in a small company with a new service or technology, it would present an opportunity to benefit if the company succeeded and the share price rose a great deal. But if the company failed, the investor would lose money. That can occur. But most of the time, the risk my clients face involves temporary drops in the value of their portfolio and the possibility that they will need to use that investment while its value is depressed. This is why advisors should ask questions about your income, your other assets, your expenses, your needs, and your future plans.

There could be other risks for you as well. A thorough analysis of your situation will examine the following risks, and maybe some others too.

Market risk – what I just described; the fact that capital markets can suddenly react to economic events and drop a great deal in value.

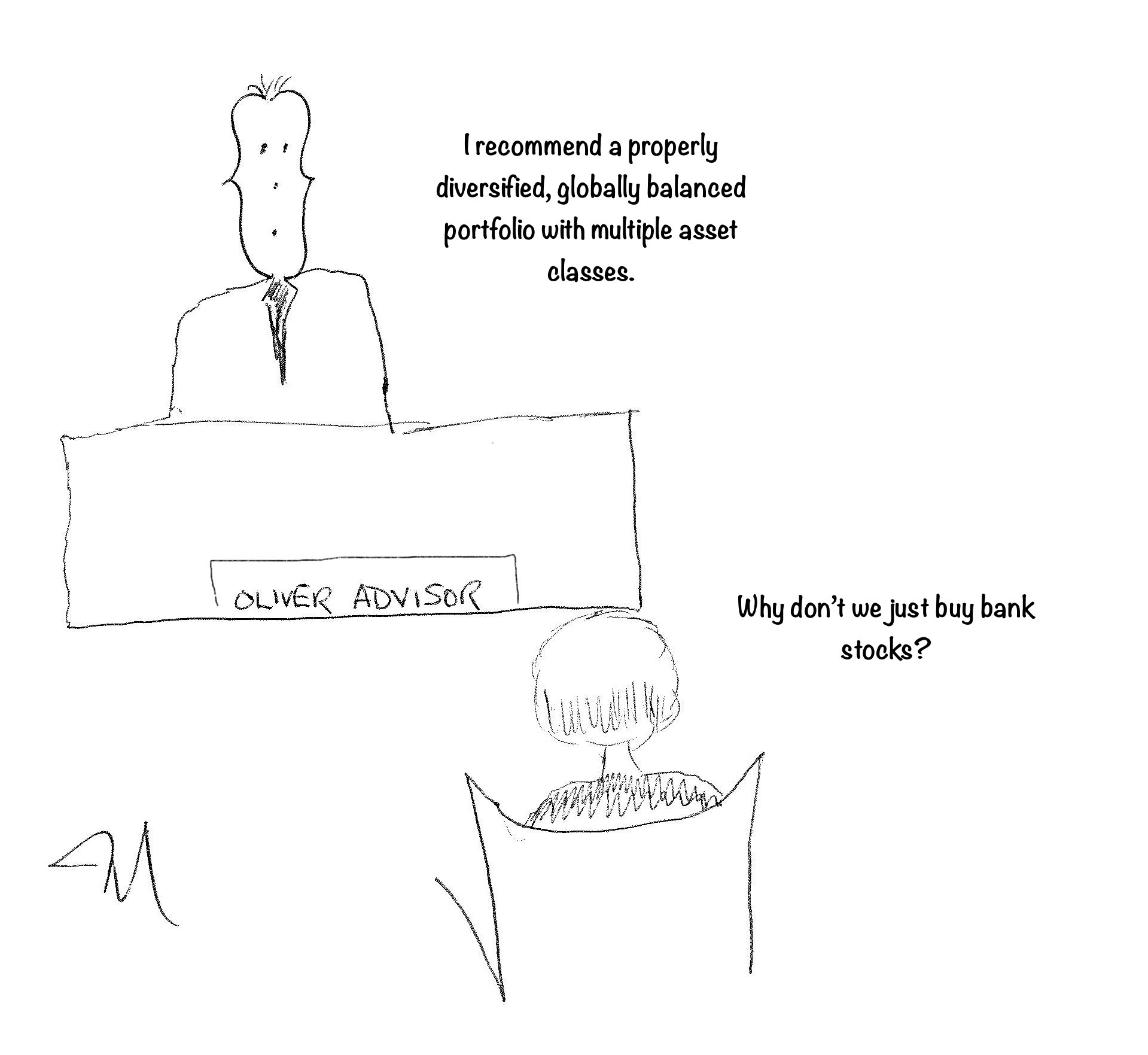

Sector risk – the exposure you may have to a specific area of the economy. If you have a lot of investments in technology companies, for example, you must be aware that the performance of that sector will impact your portfolio.

Security risk – the impact of a specific holding. If you work for a company whose stock is publicly traded, you may accumulate a lot in that one company. There is a risk that that company will underperform. I’ve seen this work both ways. I’ve had clients amass small fortunes in company stock over years. I’ve had others who took a hit to their wealth when the company they work for faltered.

Concentration risk – comes with a profound bias in your portfolio, like the ones described above.

Interest rate risk – some investments are affected more than others when interest rates change. Rising rates will normally make bond investments fall in value. That’s right, rates going up to make bonds go down!

Credit risk – the strength of a borrower (company, country) to incur debt and maintain it by making loan payments on time.

Currency risk – if you have investments in other countries, but your expenses are in Canada, you must be mindful of the performance of that country’s currency in relation to the Canadian dollar. Or, If you own a stock of an American company, the stock could perform well, but if the US dollar weakens in relation to the Canadian dollar, it will work against you and lessen your gain from the stock.

If you have a vacation property in the US and need to cover expenses related to it, and all your income is in Canadian dollars, you carry the risk that those expenses will be a greater burden for you if the US dollar increases in the relation to the Canadian dollar.

Inflation risk – your income (while working or in retirement) needs to be able to increase as costs do. Anything that gets in the way of that such as a pension that is not indexed, presents you with inflation risk.

Mortality risk – generally what life insurance is for; the risk that you will die and that it will financially impact those close to you.

Longevity risk – the opposite of mortality risk. This is the risk that you’ll live a long time. Your financial plan needs to address this possibility.

Style risk – markets go through periods where they favour certain types of investments for their attributes. If your investments, or the manager of your investment funds, has a style that favours certain attributes, you carry the risk that you will underperform if the market is not rewarding those attributes.

Performance risk – the risk that the approach you are taking will underperform in relative terms. You may have positive results, but were they as good as they could have been? Every bias in your portfolio, every risk mentioned above that is handled a certain way, presents the risk that you will not do as well as you could have.

Risk is a four-letter word, but it doesn’t need to make you uncomfortable. Thorough analysis and planning will identify these risks (and others too) and have a plan to mitigate them. This is something I do for all my clients. For those who don’t work with me, I encourage you to undertake this analysis on your portfolio and on your financial plan. And, I’m very happy to offer my help if you need it.