The recent passing of one of Hamilton’s icons, businessman and philanthropist Charles Juravinski, was cause for reflection. I had the pleasure of being in his company on several occasions. If you had ever met him, you’d know that he was as big a character as he was a success.

A true rags-to-riches story, Charlie came to Ontario from Saskatchewan as a young boy with nothing but the clothes on his back. After years in business, he and his wife Margaret would donate tens of millions to local hospitals. Building their business wasn’t easy. I was with him when he told the story of the troubles they faced and how at times they risked losing a lot, if not everything. I asked if he was ever scared. “Scared?” he asked as if to consider it. “No. Concerned, yes. But scared, no”.

It was consistent with what I had noticed about those who have built exceptional wealth. There is one distinguishing characteristic they share. You might be surprised by what it is not. It is not exceptional business acumen or a knack for numbers. It is not a skill such as being shrewd or tactical or being able to make big deals. It is not the ability to recognize some need or trend and to capitalize on it while it goes unnoticed by others.

From what I’ve seen, it is this. It is the way they view risk.

This is not to say that they are risk-takers. The people I’ve gotten to know who have built exceptional wealth for themselves identify, assess, and mitigate risk. They are not reckless. They are not gamblers. But once they’ve considered the risks, they have a way of looking at it that can be different from the way most others do.

They will say, “what are the worst things that can happen?”. They will look at an opportunity and say “why would I not do this?” They will recognize risk as possible, but then ask “but how likely is it to occur?”. What’s more, they will sometimes concede that certain things are likely to occur and then they say “so what? That doesn’t ruin everything. That’s just something that happens. I’ll deal with it”.

Finally, they will often say “the biggest risk is not doing anything”.

I’m exploring this because it’s very important to understand your relationship with risk. It involves several things. It involves numbers and data such as the chances you’ll need the money you’ve invested and the expected volatility of your investments. It involves your unique circumstances. And on top of all that, it involves your mindset, your comfort level, your personality, your past experience, and your values.

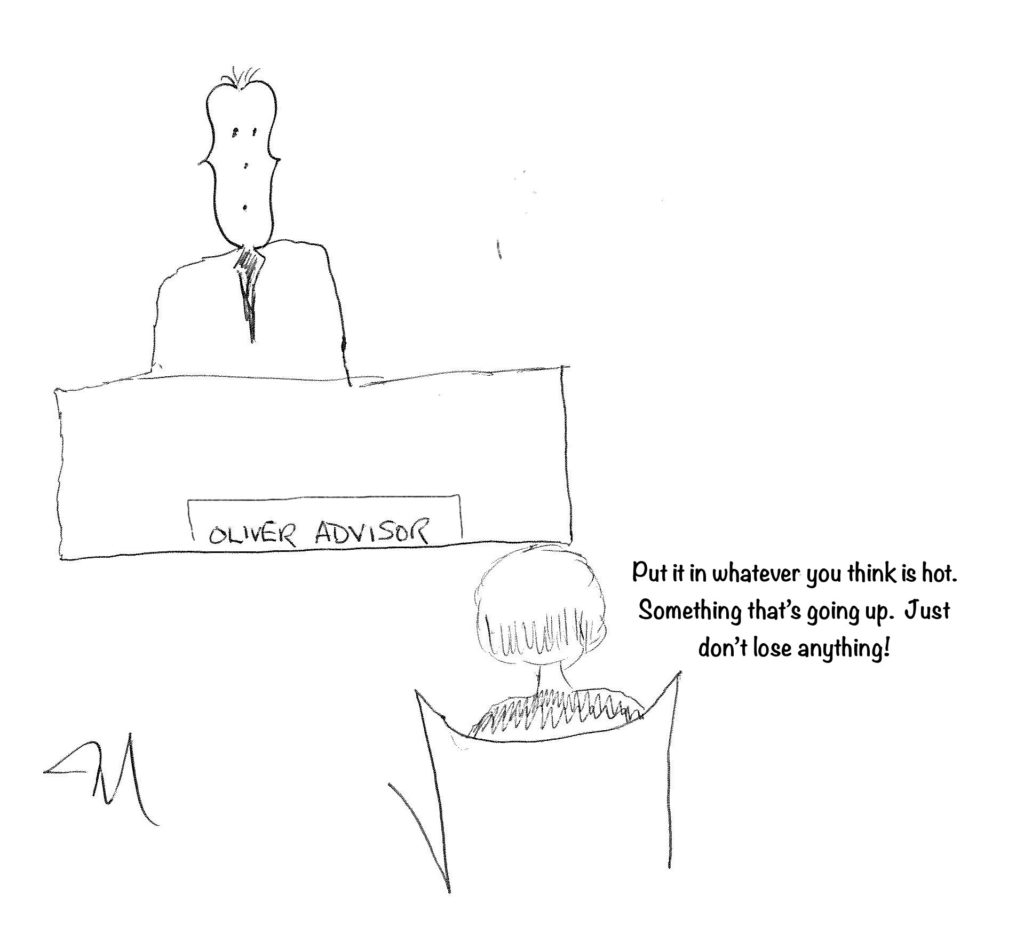

Portfolio construction is mostly an exercise in risk management. If we weren’t trying to manage risk, we’d put all our effort into finding what we believe to be the single, absolute best investment and we’d put all our money into it. But instead, we diversify because there are many unknowns and there is the distinct possibility that we will be wrong about certain things.

Acknowledging that there are risks and unknowns doesn’t make us turn and walk away. We come up with a plan to reduce them. We base it on data that makes our strategy highly likely to succeed. We move forward with confidence even though there are no guarantees. We monitor and reevaluate along the way.

The current investment climate has challenges. We are coming off several consecutive years of strong stock market returns. Most would say we are midway through an economic cycle. Interest rates and inflation are on the rise. Geopolitical tensions and the economic effects of the pandemic complicate things even more. But it’s not time to turn and walk away. It’s time to identify, assess and mitigate risk and to do it in the context of your circumstances and your sensibilities.

You don’t have to think exactly like Charlie to build wealth. But you do need to reflect on your relationship with risk to ensure you remain comfortable throughout the process, confident in the outcome, and steadfast in your approach.

I have a lot of experience in leading that conversation and helping investors to uncover their investment personalities. Outstanding advice goes beyond the practical factors and ensures the strategy is aligned with who you are.