A few weeks ago, I challenged the way financial planning graphs typically appear with smooth lines and steady, consistent results. Financial plans are formulated based on the assumptions we choose and on long-term averages. But life doesn’t work that way.

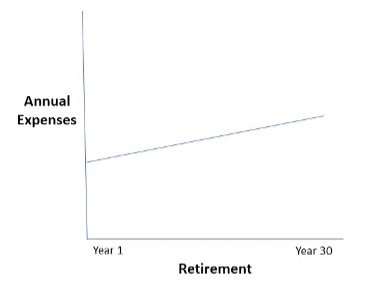

One part of your plan that will be anything but smooth, consistent, and predictable, is the amount you will spend in retirement. Planning software will typically start with the amount of money you hope to live on at the beginning of retirement and it will adjust it each year for inflation and maintain it until the end of the plan. It looks like this.

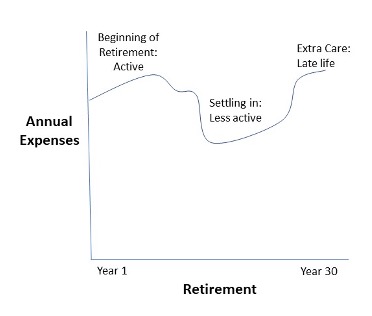

But that’s not how your retirement will actually play out. Retirement, like all other times in your life, will involve various eras. When you were starting out in the workforce, you had a certain income, lifestyle, and expenses. Things changed when you bought a home and maybe had children. They changed again when those children got involved in activities or when they entered post-secondary education. The pace of your life changed, your day-to-day commitments had a certain focus, and from time to time, it was repositioned and life evolved. Retirement is no different.

For some people, the first era of retirement involves some form of continued work or professional engagement but with more flexibility and time off. For others, the first few years are very active as they take big trips and do the sorts of things that limited vacation time during working years precluded them from doing.

But that doesn’t last for decades. People get it out of their system and then settle into a different pattern. They enter a new “era” in their retirement. Sometimes it is driven by their children and grandchildren and the desire to be close to them or to be involved in their care and in witnessing milestones. And quite often, eras in retirement will be determined by your health or the health of your partner. So your expenses will probably look more like this.

I can manipulate the planning software to model different eras and different levels of spending. It is still a function of the assumptions we choose and that is difficult to know or to get perfect. But it can nonetheless provide a sense of comfort that your spending is sustainable. This is very important. For many people, financial anxiety peaks just before retirement as they question whether they are making a prudent decision and if they’ll be ok. Couple that with their desire for the first few years to be active with higher spending and it is common for people to fear that they’ll blow through their savings too soon and not leave enough for the long term. A plan that models different eras and uses conservative assumptions can alleviate those concerns.

And that was planning is really about. It’s not entirely about choosing a course of action that you have to stick to. It’s about testing the scenarios that matter to you. What if you spent more for the first few years? What if you were willing to spend less as time went on? What if you needed more income late in life to provide for your care?

If you work through this and are comfortable with it, you’ll can allow each era to unfold as life does, and enjoy financial peace of mind.