I remember when I was a young guy in my twenties and I first got acquainted with the idea of putting a little money away each month and watching it grow. The information I was reading at the time had these pithy points to condense what you needed to know into a few actionable phrases.

Start early. Pay yourself first. Stay invested.

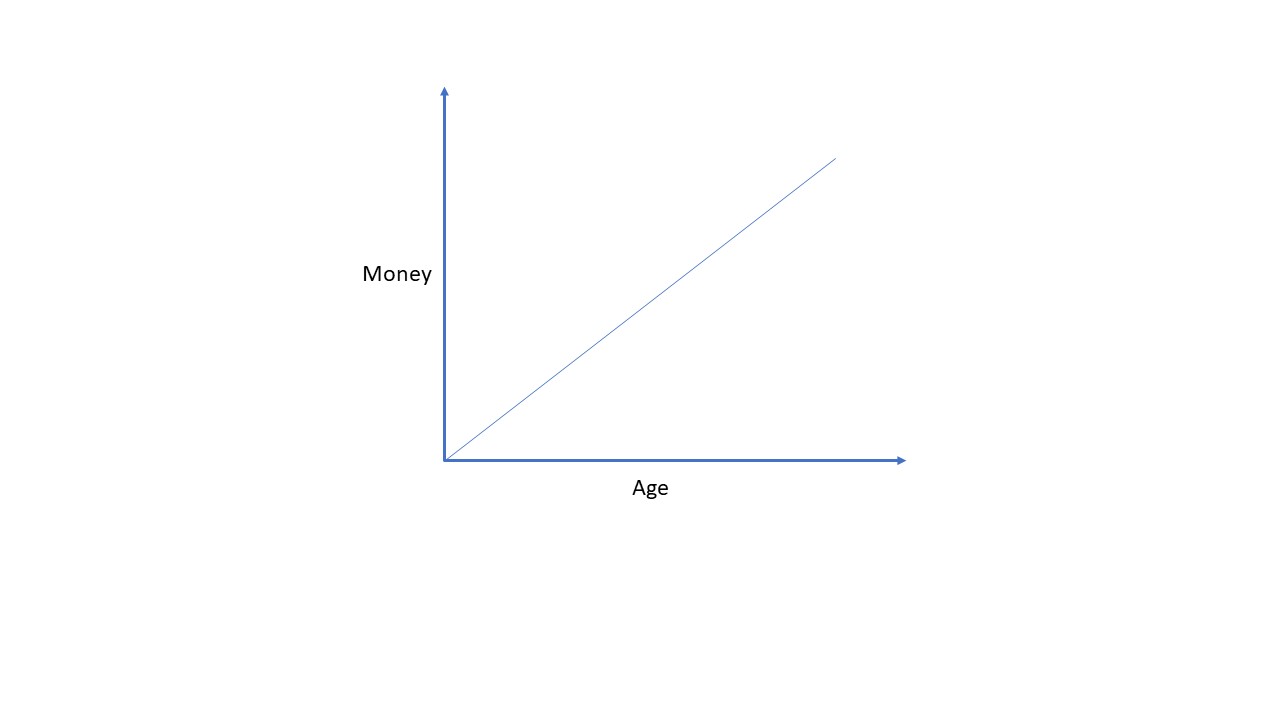

And along with it was a chart that showed your money growing consistently until you had what seemed like an outrageous sum when you were 65. The chart looked like this.

And I did it. It was 1992 and I had my first real job making about $28,000 per year. I was single, living with my parents and I invested $150 per month in mutual funds. And then…, life changed. I got married. I bought a house. I had a child. You’ve heard all this before. But the point is, things don’t happen in a straight line. Most people save a little when they’re young. They take a few steps forward, then they stand still for a bit (and hopefully don’t take too many steps backward). Then they start moving forward a bit more quickly until they’re running and finally sprinting to the finish line. Retirement!

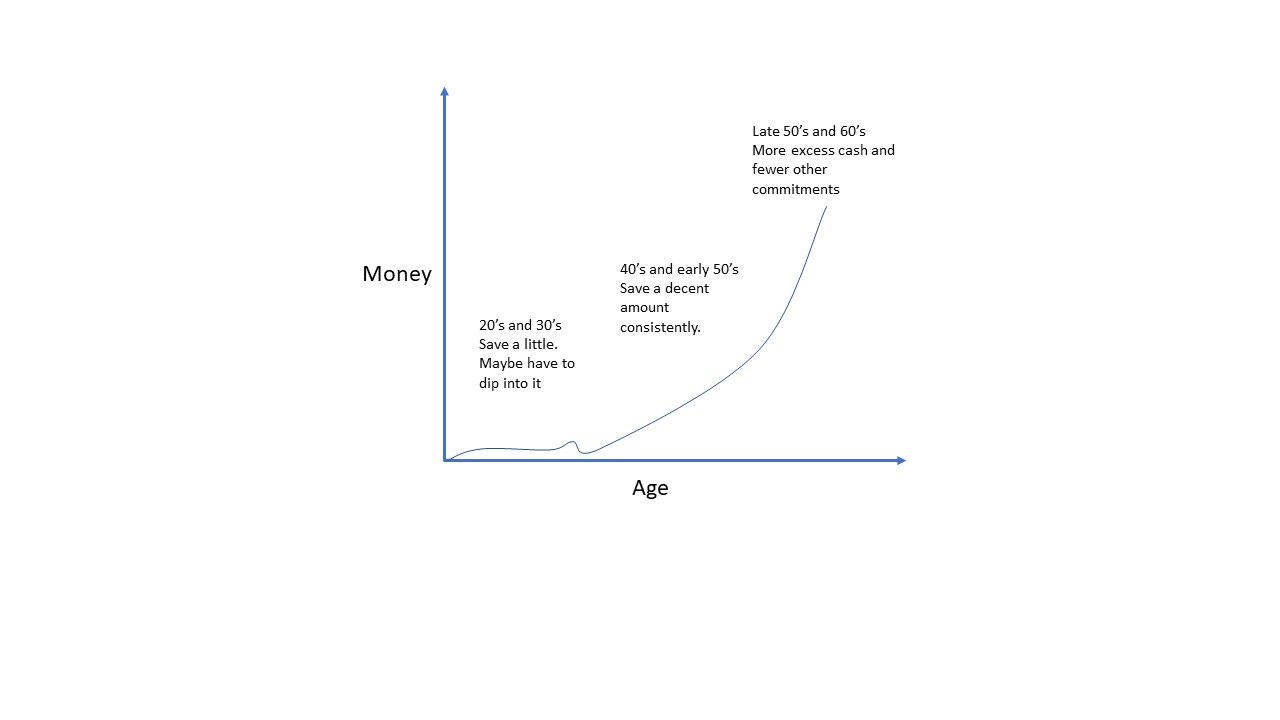

This is what the chart typically looks like.

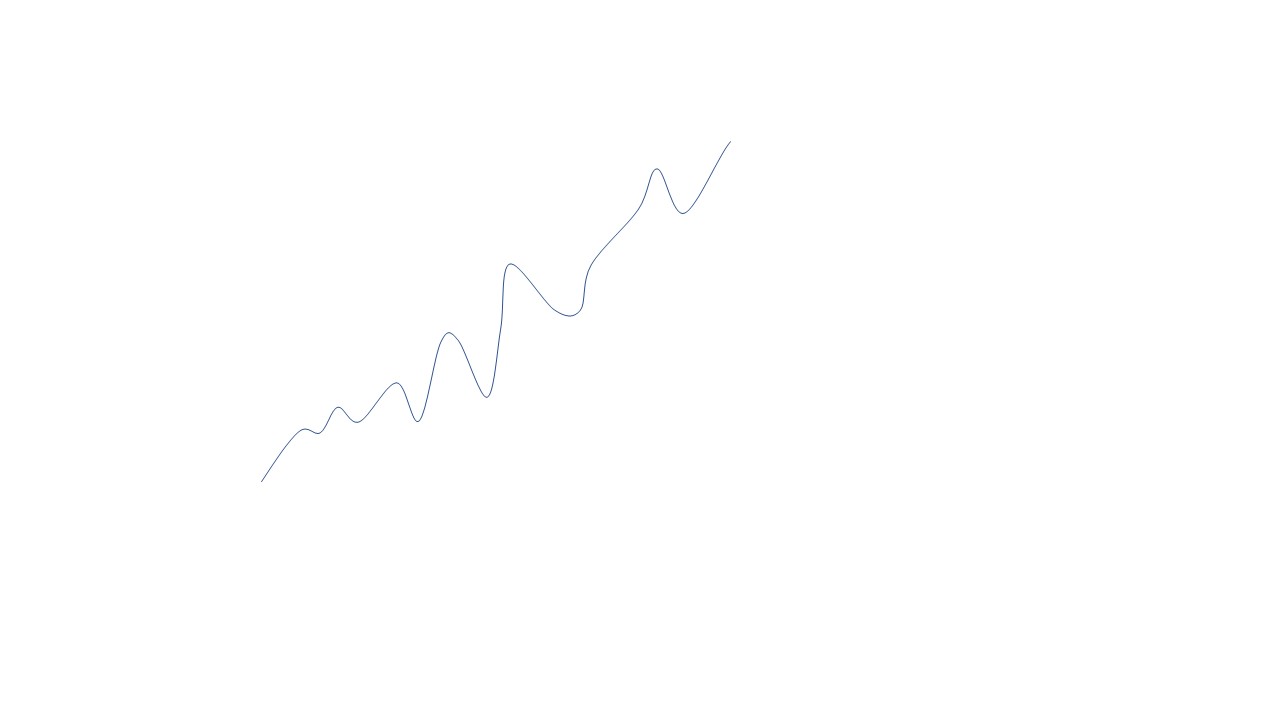

And the section of the chart where there is a steady incline, well, it actually looks like this.

From what I’ve seen, retired people don’t have charts that look like this.

They look like this.

And even this.

So, what’s the point, aside from I might be running out of ideas for comics?

If you’re young, give your money attention, but don’t get too fussed if it seems like you’re not getting anywhere. Expect things to get easier as your income grows and some of your other commitments like a mortgage and the cost of raising a family subside. Try to save something, however modest, and try to not stop when things are tight. It helps you to develop a habit of saving and a mindset where what you have available to spend is calculated only after you’ve saved something. It might seem that you have very little and that the opportunity for compound growth is minimal. But people who started early and maintained the discipline will tell you that they were pleasantly surprised one day when they looked at their balance and they were grateful that they stuck to it. Success can sort of sneak up on you.

If you’re middle-aged, embrace volatility. It is your friend when you are accumulating. You are a buyer and you will be for a good number of years. If you were shopping for anything else, you’d be thrilled if the price suddenly dropped. So view bad markets as opportunities.

If you’re retired, or close to it, take steps to secure your retirement income. Have a strategy to manage volatility if you need your investments for income. Unlike when you were an accumulator, volatility can be your enemy at this point. You don’t need to fear it because it will always be there. But have a plan to manage around it. And don’t be surprised if the value of your investments holds up nicely in retirement. Your next challenge may very well be figuring out what is going to happen to all of it when you’re gone.

Whoever you are, let me know if you need help. I’ve done this many times for many people and I will do my best to see that your face looks like this.