In my previous blog, I explored the factors involved in deciding to give some money away in your life versus making it all part of your estate. The main practical and financial considerations are whether you can afford to and determining how much you can comfortably part with while still leaving yourself in a strong financial position. That leads to the question, how much money will you need?

I believe that at the root of that question is, how much will additional care cost as you age?

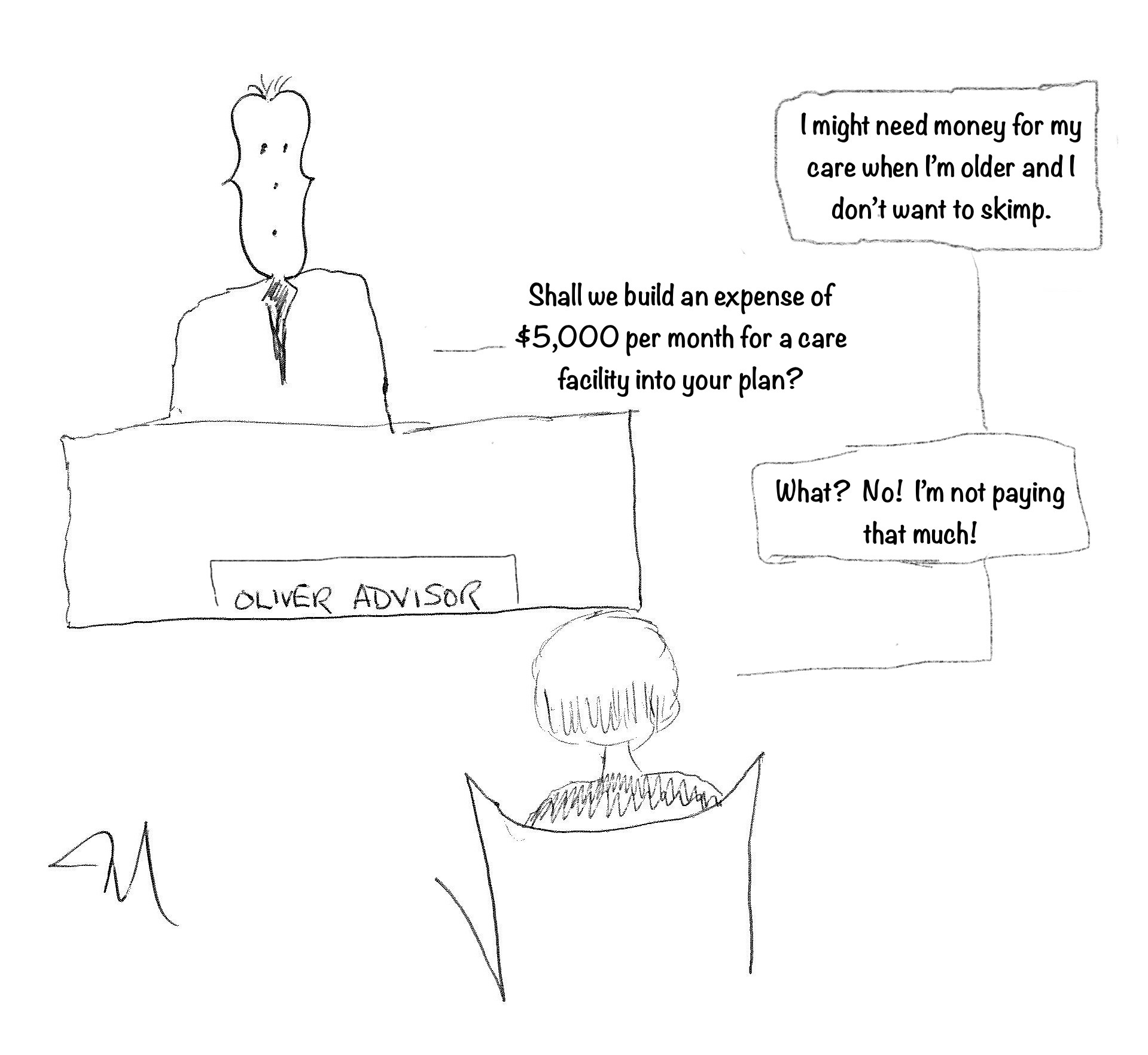

It’s easy, after all, to calculate how much money you’ll need in retirement when you’re healthy and living independently. That answer is, the same you need now. Maybe you’ll need a few extra dollars for an active retirement that includes travel and hobbies. Or maybe you’ll need a few dollars less if life is simpler or you become less active. But in my experience, none of that really moves the financial needle very much. What people are really saying when they clench the money in their hands because “I might need it when I’m old” is that they might need more care someday.

Here is what I’ve learned about this and the costs associated with it. There are three main circumstances a person may fall into if they are becoming less independent.

Staying in their home, but receiving help. This could be a simple and inexpensive as paying people to mow your lawn, clean your gutters, shovel your snow, do your shopping or bring your prepared meals. And it could be an arrangement that offers more support such as personal care and overnight care. Depending on the level of independence and the complexity of the support, the care is most often provided by Personal Support Workers. The cost can range from $20 to $40 per hour depending on how you source the services and the complexity of the care required. If the goal is to remain at home as long as possible and the needs are great, it may make more sense to have a caregiver who lives with the person. The workers are often brought in from outside Canada with costs generally in the area of $3,800 per month.

Moving to assisted living or retirement home. There is quite a range of costs depending on the level of luxury of the facility and the services required. Retirement homes usually have a flat price for room and board with a menu of a la carte personal services that might include bathing, dressing and dispensing medication. The cost is in the area of $3,500 per month at the low end and $6,000 at the high end.

Moving to long term care aka a nursing home. The costs for Long-term care are set by the provincial government in Ontario with a range of roughly $1,900 for shared rooms and up to $2,700 for a private. You may have some other costs for personal care items or assistive devices. But generally, your activity is limited at this point and your spending, outside of the cost of the home, is minimal. An excellent resource for all of the issues associated with this is The Indispensable Survival Guide to Ontario’s Long-Term Care System by form CHTV reported Karen Cumming and co-author Patricia Milne.

It’s worth noting that in the second two scenarios, the person leaves their home so it could be sold and the proceeds can create a substantial sum for investing and generating income to cover the costs. In addition, the costs for the facilities are fairly comprehensive and the individual usually will have not many additional expenses. While the sum for the facility may seem high, a person who is leaving their own home will no longer have property taxes, utilities, maintenance and usually won’t have automobile expense anymore either.

So what is the likelihood a person will face these circumstances? A study at the Centre for Retirement Research at Boston College categorized seniors’ lifetime needs as low, medium and high as well as the duration as short (less than one year), medium (one to three years) and long (more than three years. They estimate that one quarter of seniors will have high needs for a long period of time. Twenty-two percent will have minimal needs and 38% will have moderate, short-term needs.

The prudent thing to do is to plan, as much as possible, for the worst-case scenario. This is something I can easily integrate into a comprehensive financial plan. Knowing where you stand and how you can deal with the uncertainties of the future can bring peace of mind, whether you plan to give away some money or not.