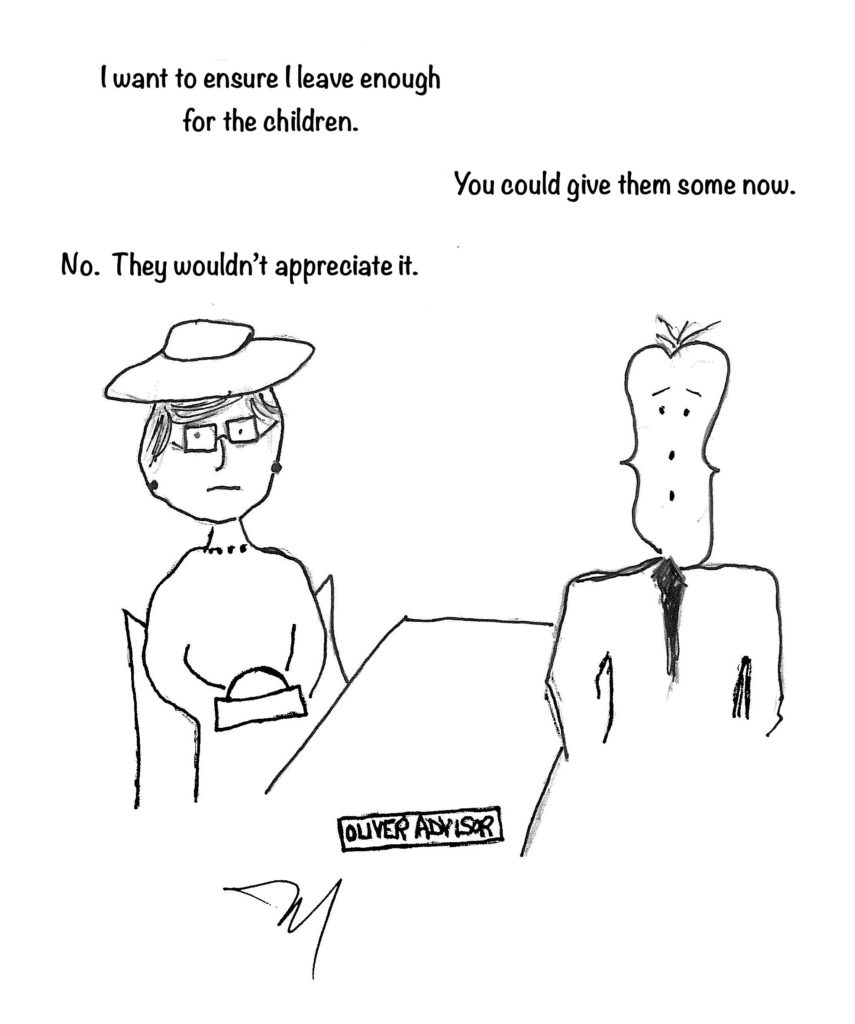

After all these years of working as an advisor, I’ve found that what really stirs people up is talking about what will happen to their wealth when they’re gone. Although we spend most of our time talking about investments, that topic doesn’t elicit nearly as much emotion and enthusiasm as talking about estate planning.

Because I deal with people who are in good financial shape, I can often suggest that they have the option of passing along some money now – in their lifetime – and not making beneficiaries wait to receive all of their inheritance. I love watching the range of reactions clients have to that suggestion. It’s everything from “Sure! That’s a good idea. I’d like to help them now when they need it” to “No way! I’ve done enough for them. This is my time. They can have what’s left, but I’m still using it. Besides, I’d probably never see them again”.

Assuming it’s something they’d consider, here are some questions I put forward to help them work through it.

What excites you about this? What positive things can this make possible for the loved ones who will receive it?

It’s common for parents to help their adult children with the down payment for their first home. Many young first-time buyers have the ability to make mortgage payments and to carry other costs, but the rapidly rising prices of homes have made accumulating the down payment difficult and a few dollars from mom and dad can be just enough to help get over that barrier. It’s also common for clients to help with their grandchildren’s education costs. I’ve also seen parents help young families to get their own financial future on track by providing the funds for RRSP or TFSA contributions.

What concerns do you have? Are you worried about the problems this could cause?

The most common concern clients have about gifting money is that it will affect the recipients’ attitude toward money. Clients fear that their adult children will take it for granted or not take enough responsibility for building their own financial strength if they know someone else is there to keep them from having to do the heavy lifting. Sometimes, attitudes about money differ from child to child making it difficult for parents who feel comfortable giving money to one child, but not another.

How much can you comfortably afford to part with now and still leave yourself in a strong position in your lifetime?

It’s mostly my job to prepare an analysis of how much they need and how much they can part with. I would help calculate the maximum amount they could give away, but it’s up to them whether they would keep the amount lower. In most cases, the younger people are, the more conservative they are and they hang on to more money not knowing what the future holds. Much older clients, however, are usually more comfortable parting with higher amounts.

What are the tax considerations that result from disposing of investments?

Again, this is my job. Selling investments in non-registered accounts can realize capital gains and losses. While money held in registered plans such as RRSPs and RRIFs presents an additional challenge as the tax consequences of taking it out can be so high, it’s not really an option.

Whether clients move forward with something like this or not, I think it’s an important discussion for me to start. It sheds light on clients’ sensibilities and priorities that relate to the most important things in their life. Being aware of that, I can ensure it is part of everything I do for them.