Last year, I had conversations with two new clients. Both were young women early in their careers who had been saving diligently and had enough to buy a house and set aside savings for the long term. It was great to see young people doing all the right things and getting on track at an early age. But what struck me most was that despite their youth and how new they were to money matters; they exhibited a wonderful mindset about investing and planning that woman demonstrate more often than men.

Women and men think differently about money. I have learned a lot about this from Kathleen Burns Kingsbury, a wealth psychology expert and the author of How to Give Financial Advice to Women (McGraw Hill). She teaches that women equate wealth with freedom and security while men feel it provides status and power. There are other differences too, but I would summarize it by saying that women are very practical about money. When presented with options or a decision, women will approach it with the question “will this help me meet my goal”? Or “will this make me more secure”? They are able to focus on what they are really trying to accomplish.

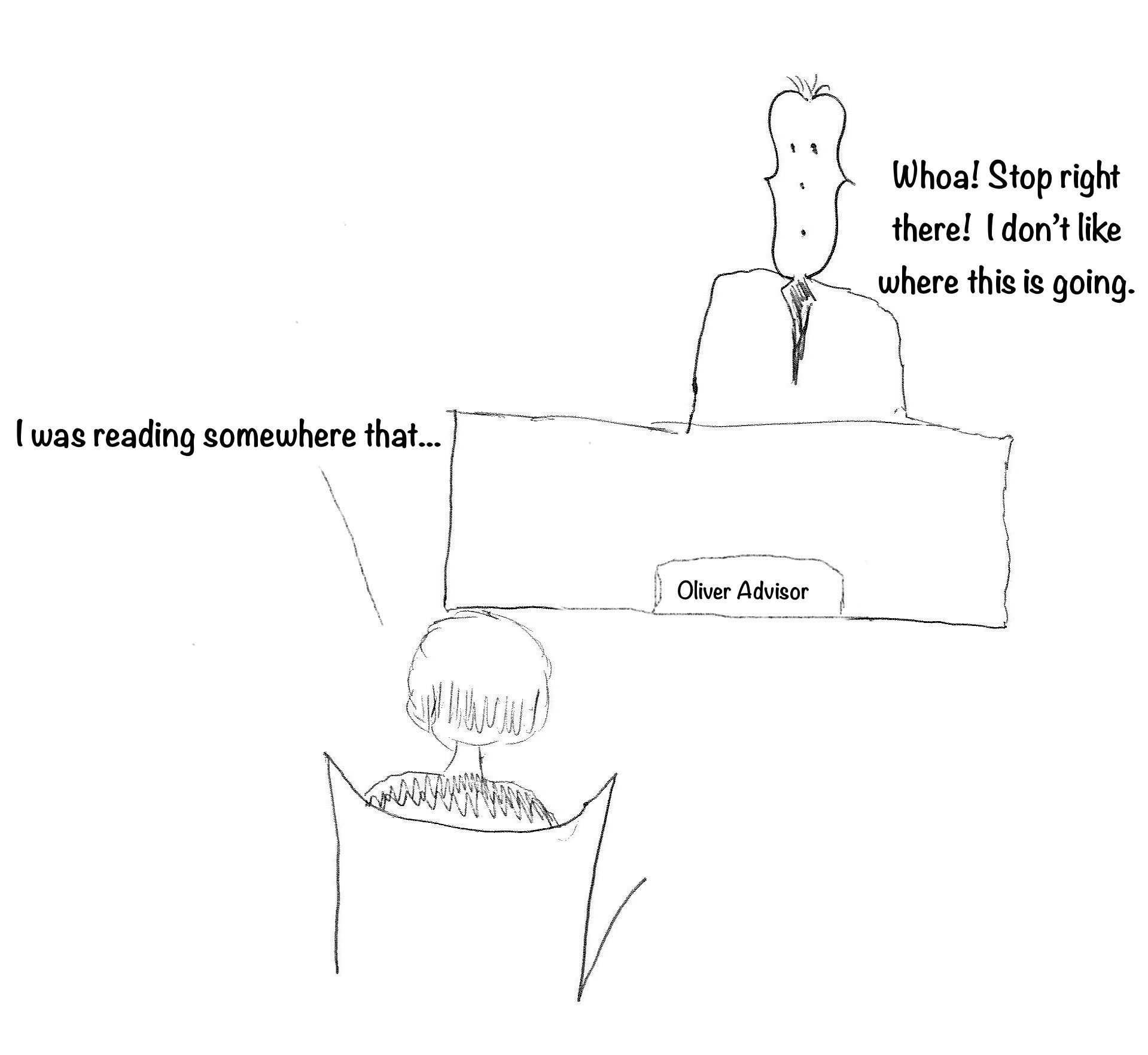

I find men enjoy the process as much if not more than the goal. They are like hunters or athletes – each transaction is like a conquest where they want to feel a sense of achievement by making money or “winning the game”. Even when it comes to reporting, men are interested in how their portfolio has performed in relation to a benchmark. It appeals to their competitive spirit. Women would prefer a goals-based report; one that tells them if they are on track to meet their goals.

The two young women were beginning to invest in the middle of a global pandemic with all sorts of risks and uncertainty, but they easily looked past it and said, “this is for the long term”. When I proposed a disciplined structure and proper diversification, I admitted that it is not as exciting as trying to find the next Amazon, but it is an effective, reliable approach. They said, “let’s do what’s effective and reliable” without looking for entertainment from the investments or seeking any other outcome than building their wealth and security. So refreshing!

When it comes to investing and financial planning, it’s helpful to be in touch with your feminine side.