Software used for constructing financial plans will often have a default approach where the income you are seeking in retirement remains constant throughout your life, albeit adjusted for inflation. So, if you and your advisor determine that, at retirement, you will require $5,000 per month after tax, the software will provide you with that amount of income every year until the end of the plan, with a little raise each year to take into account inflation.

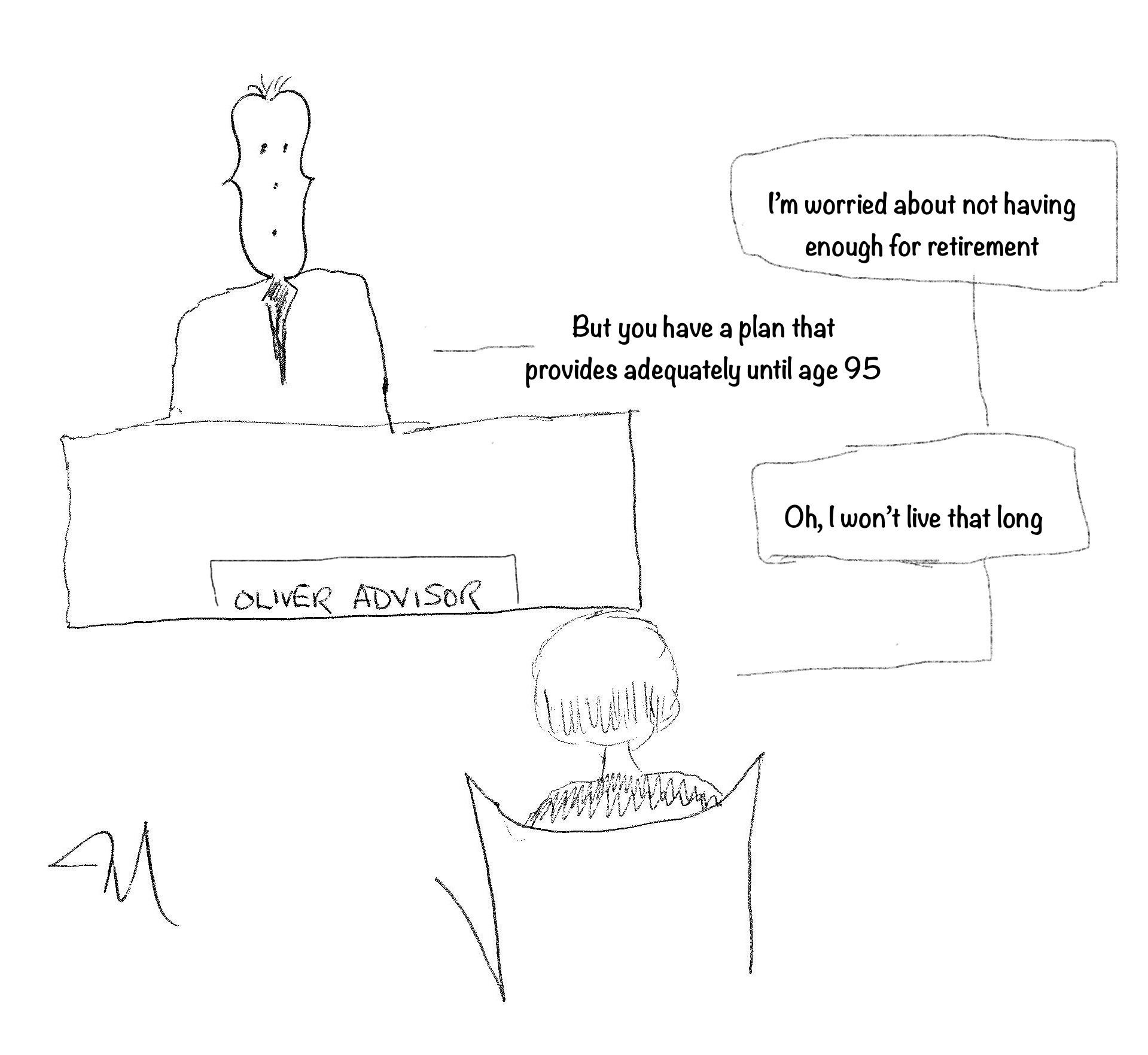

Over the years, I find that clients know intuitively that this is not how things will really unfold. They often say to me, I won’t need as much income down the road when I’m much older. Is there a way you can calculate higher income in the years at the beginning of my retirement when I’m healthy and active if I’m willing to live on less when I’m older and less active?

I can do that, and I usually do. But the question then becomes; at what age would you be comfortable having less to spend? There has been an incredible amount of consistency from people around that answer; age 80.

No one is saying that life ends there. They are just saying that they probably won’t travel as extensively or play as much golf after 80 as they did before 80. I’ve talked a great deal with my clients about this, and most people have observed the experience of many others they know to arrive at this number. They search their mind and think of friends and family members to try to see when people typically fall into a different pattern in retirement. Again, it’s not that you won’t travel or spend anything after 80. But if most people retire in their sixties, by the time they reach 80 they’ve done the big trips and adventures and have settled into a different routine.

Retirement lifestyle researcher and consultant Barry LaValley would say that there are different eras in retirement. The first few years are when people take the big trips, maybe downsize homes or change communities. He says that in most cases, the switch to a different routine or era is usually brought on by your health or the health of your partner. Finally, he’d say “do as much as you can, as soon as you can”.

The point is not to convince you of what age you should slow down. I encourage you to break records past age 100! The point here is that detailed and thoughtful financial planning can support and model different scenarios and give you the confidence to do more (spend more) at times, understanding that you might not need as much later on down the road. It’s about using planning to allow your life to be as fulfilling as possible. It about tailoring the plan to your needs and not accepting the software’s default solution.

So, with that I ask, how do you see your retirement unfolding? Is there an age where you see your routine being less active? And at what age would you adjust your plan for less spending?