One of the most important things an advisor must do is to assess the appropriate level of risk for clients’ investments. There are many ways to do this. It’s part science and part art.

Time horizon is the key determinant. Advisors will ask if you will need the money in the near term, such as if you plan to buy a car with the money within the next year. In such a case, you wouldn’t want the money to be exposed to a possible drop in value. There wouldn’t be enough time for the value to recover.

There are also surveys that gather information like time horizon and attempt to assess the investors’ reaction and sensibility when markets go through their inevitable bear phases.

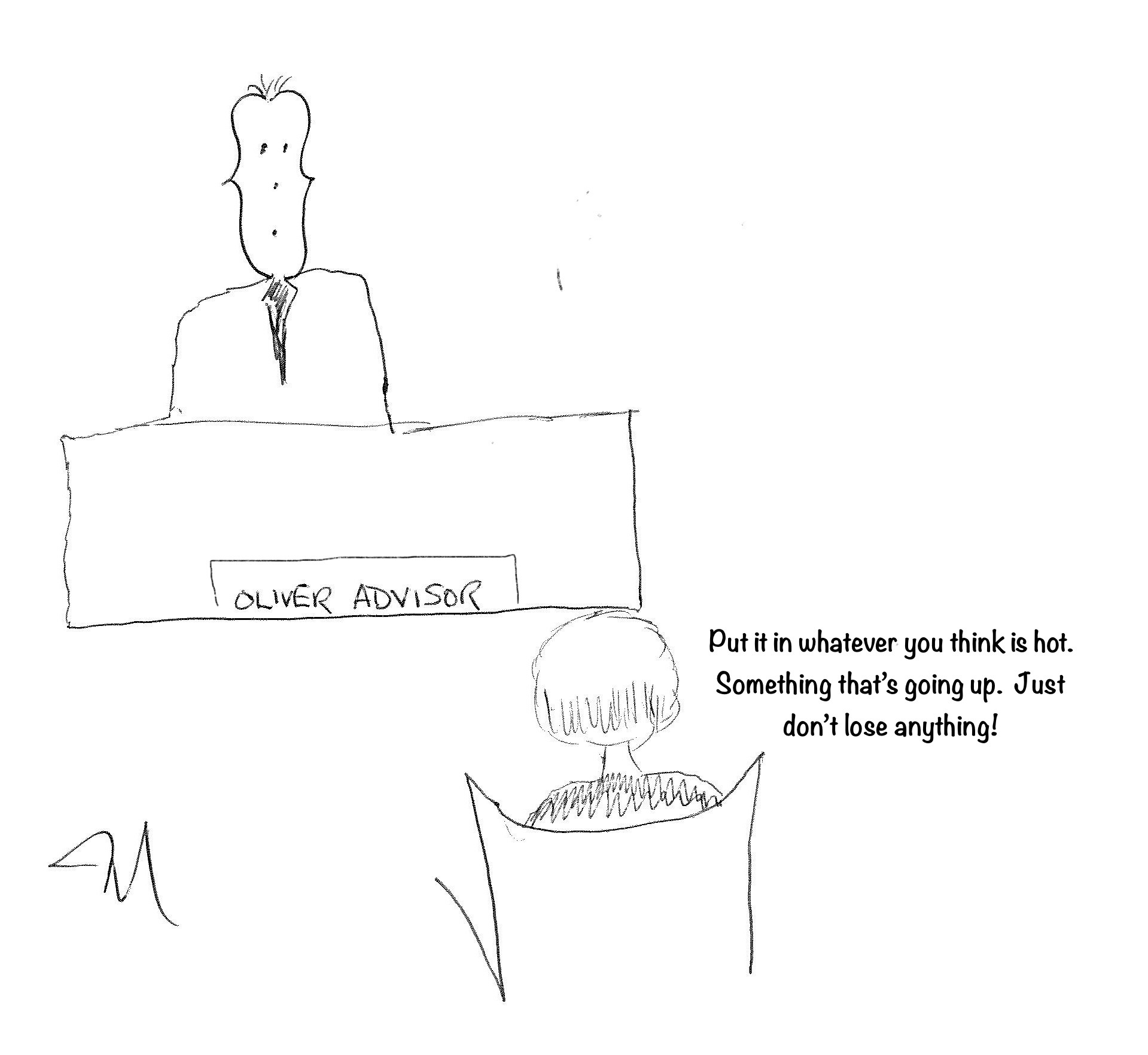

These are examples of what I call the “scientific approach”. They are important and should be used. But I also think we should look to the subconscious mind for clues as well. Watching how people choose their words tends to help me understand what they are looking for, and what they really mean. Let’s look at these two ways a client may express what they’re looking for from me.

- “Make me money. Just don’t take on too much risk.”

- “Keep my investment safe. But try to make me some money.”

It seems like they say the same thing doesn’t it? But I think they are saying something different. It’s clear they both understand that there is a relationship between risk and reward. The first investor is focused on returns. He or she is investing for growth, but understands that to achieve it, one must be willing to take on risk. The second investor is focused on safety. That’s the first thing on that person’s mind and the most important thing. While accepting that there will be ups and downs, the person is hoping they will be minimal. They are asking the advisor to try to keep them in a comfort zone where the bad days won’t be so bad. And they also understand that playing it safe will mean returns will be lower and they are ok with that.

That’s a lot of reading between the lines as an advisor. But I wouldn’t stop there. I’d explore it with them. I’d say something along the lines of “I noticed that you said… Some people say….” Then, I’d articulate these two perspectives and validate that that is indeed what they meant and how they feel. It’s an important exchange between an advisor and a client. It helps the advisor to understand a client’s goals and risk tolerance, as well as provides a backdrop for setting expectations with clients.

So, now that we’ve covered this. When I ask you about risk, what would you say first?