In difficult markets as we are experiencing now, I often hear people in or near retirement say that what concerns them is that they don’t have as much time for things to recover as when they were younger.

Well, you’re younger than you think … from an investing point of view.

Whether you’re retired or close to it, you’ll only use a small portion of your investments in the near term. Most of your money will be there for you for a long time. You’re still a long-term investor, even if you have short-term needs.

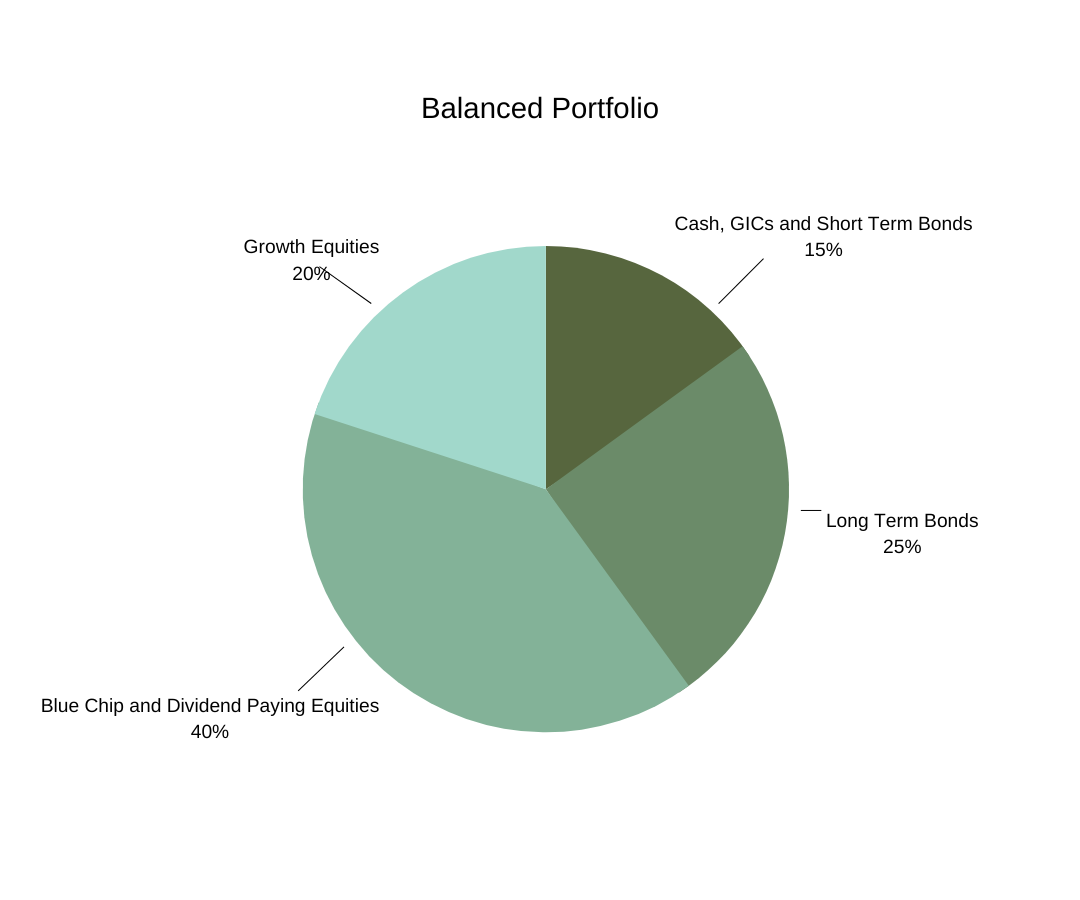

Consider someone with $500,000 in a balanced portfolio, which usually means 60% of the money is in stocks or funds that hold stocks. The remainder is in bonds and short-term investments.

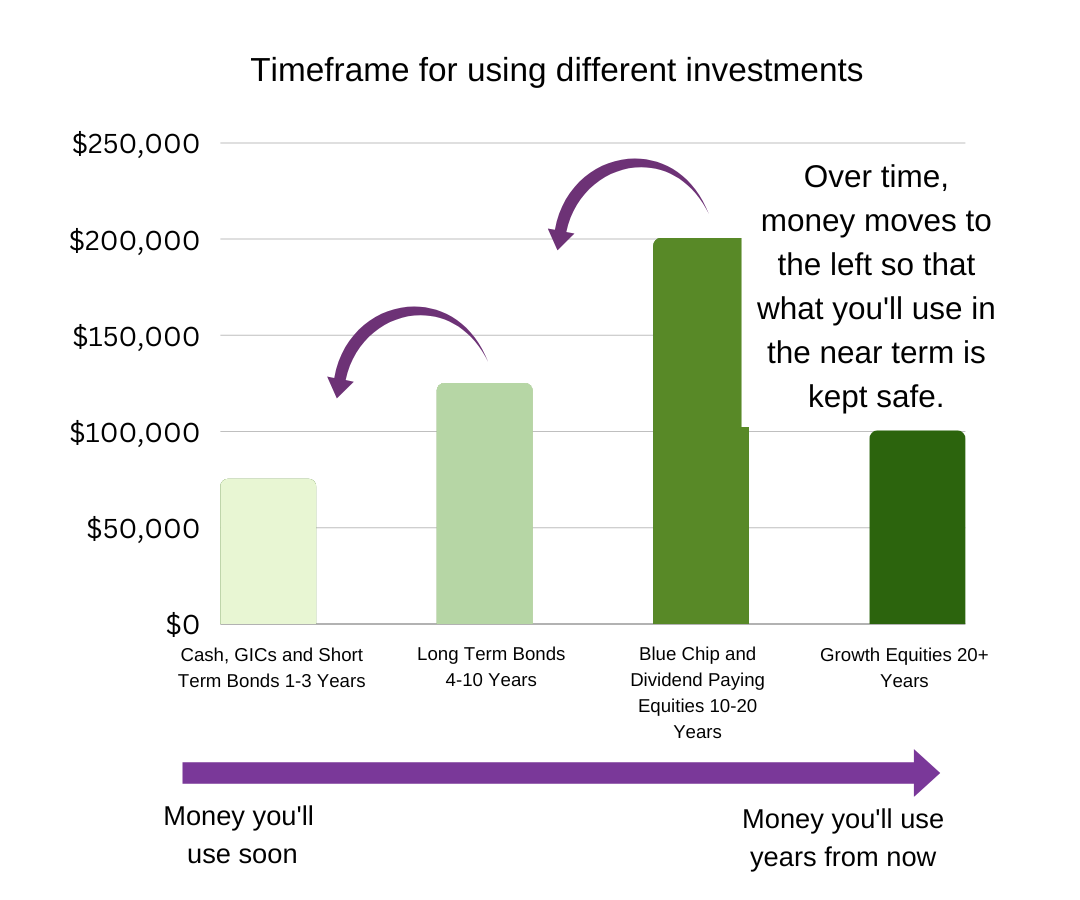

Let’s say that an investor wants to draw an income of $2,000 per month. At a reasonable growth assumption of 5% annually, that money will last for 25 to 30 years. If the amount withdrawn is adjusted upward for inflation each year, about $75,000 or 15% of the original total will come out in the first three years. That money should be in cash or short-term investments that are less exposed to market volatility. It gives the remaining money at least three years to recover.

If we take the investments from the pie graph above and lay them on the timeline shown below, you can see that the investor will take from the cash and short-term bonds first, then from longer-term bonds. It will be closer to 10 years before he or she even starts to use the money that is now in stocks. Some of todays dollars in stocks won’t be used for 20 to 30 years.

I say “now in stocks”, because as time goes by, money will need to shift to the left to lower risk and replenish the envelope where money is kept safe for short-term use.

If you don’t need your investments to deal with expenses or meet your day-to-day needs, then the decision to hold more equities is purely a result of whether you are comfortable with it and what sort of long-term return you wish to achieve. Either way, age alone shouldn’t determine your asset mix.

This is why planning is just as important as investing. The two work together. The plan forecasts what you’ll need, when you’ll need it and which investment plans, if any, will fund it. The investments are structured to make the plan work and leave you in the strongest long-term position.