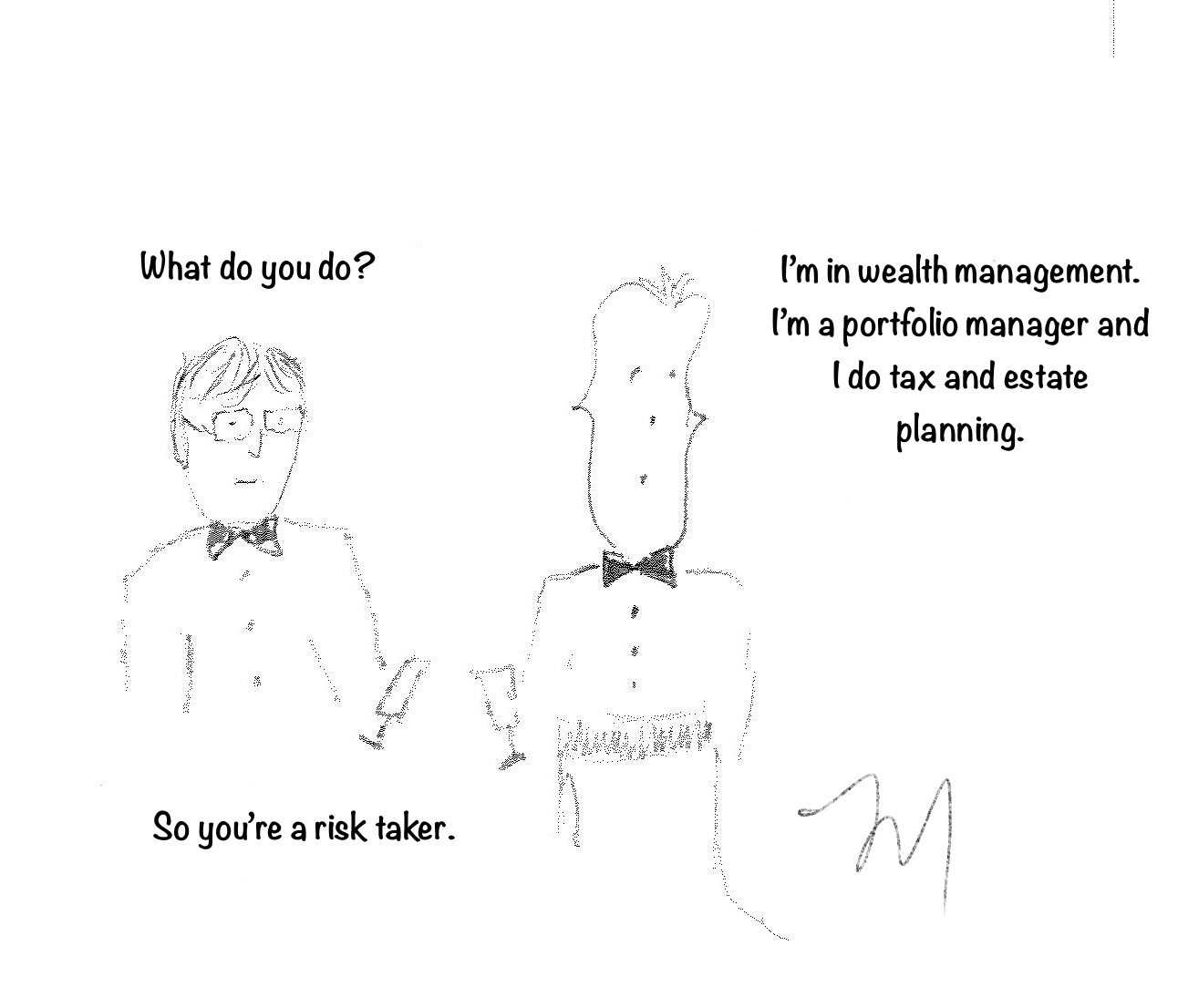

I reached out to a group of clients and asked for topics that they would like to know more about, so I could write blogs about them. One of my very first clients – someone who has known me and worked with me for over 16 years said this… “Could you explain what you do for people?”.

It wasn’t the first time that a client or a non-client needed clarification on what I do besides invest people’s money. The range and scope of my services are quite broad. The degree to which anyone client avails of my services is a function of what life brings them and their willingness to share that with me so I can identify gaps and propose solutions. Below is a list of some things that I’ve worked on over the past little while. Now, some may surprise you! The issues that are most important to clients – or should I say most stressful – require some difficult and deeply personal conversations. Their trust in me and their comfort in divulging the details of a difficult situation help me to propose solutions that make financial sense, and also are in line with clients’ personal values.

Happens all the time

Happens all the time

- The client is close to retirement. I formulated a plan that forecasts cash flow in retirement, identifies tax issues, and projects the value of her estate at points in the future.

- The client dies and his RRIF rolls over to his spouse. I assessed the spouse’s new financial position and put together a strategy that provides her with security and the means to live life comfortably. Ensured that she had adequate cash flow, but also talked a lot about the family home and supported her decision-making around whether to stay and how to finance improvements and maintenance.

- Many clients have properties and spend time in the US. I have a strategy for generating US income and being mindful of their USD expenses to minimize the risk associated with exchange rates.

Happens less often

- The client takes the next step in a relationship and becomes common law with the partner. I merged their investments and their financial plans. I guided discussions about planning their estate and proposed strategies.

- The client is paid back a large loan they had given that was generating substantial interest income. I formulated an investment plan with dividend-paying stocks that generate close to the same amount.

- The client’s father dies and leaves an estate for his wife who is elderly and in care which my client must manage. I helped the client anticipate possible changes to the mother’s financial needs and helped her to choose prudent and appropriate investments.

- The client is divorcing and is inclined to seek a lump sum from the former spouse rather than ongoing support. I put together a financial plan that demonstrates her level of security and supports her preference for a lump sum. I Helped her to understand what her income will be in the future. Will construct an investment portfolio when monies become available. The client still needs to find a home and decide whether to rent or buy. Either way, she sees the path to security and self-sufficiency.

- The sibling of an older client died in another country with no next of kin. Helped him to strategize about bringing the inheritance back to Canada and understand how it fits into his family’s wealth plan. It includes his children, one with special needs.

- The clients’ child is ending a relationship and needs some financial help. I help them explore various options including giving the money outright, lending it, buying a property for the child’s use, holding the mortgage on the property. In this case, this needed to fit into the client’s wealth plan, especially the estate planning aspect and consideration of other children.

- The client’s adult child returns home after the end of a relationship and the loss of employment. The child has lifelong struggles with depression. I helped the clients work through the best ways to support the child’s journey back to self-sufficiency.

Whether the challenge is common or rare, they take place within the context of the client’s unique circumstances. Having deep personal relationships and understanding my client’s values allows me to propose solutions that are appropriate for them financially and emotionally and fulfills my commitment to connecting their wealth to what is most important to them.