According to a recent survey, 91% of seniors said they would try to “live safely and independently in their own home as long as possible.” This contrasts with the long-held view that as boomers age, a wave of selling and downsizing would come as they relocate to smaller homes, condos, and retirement communities.

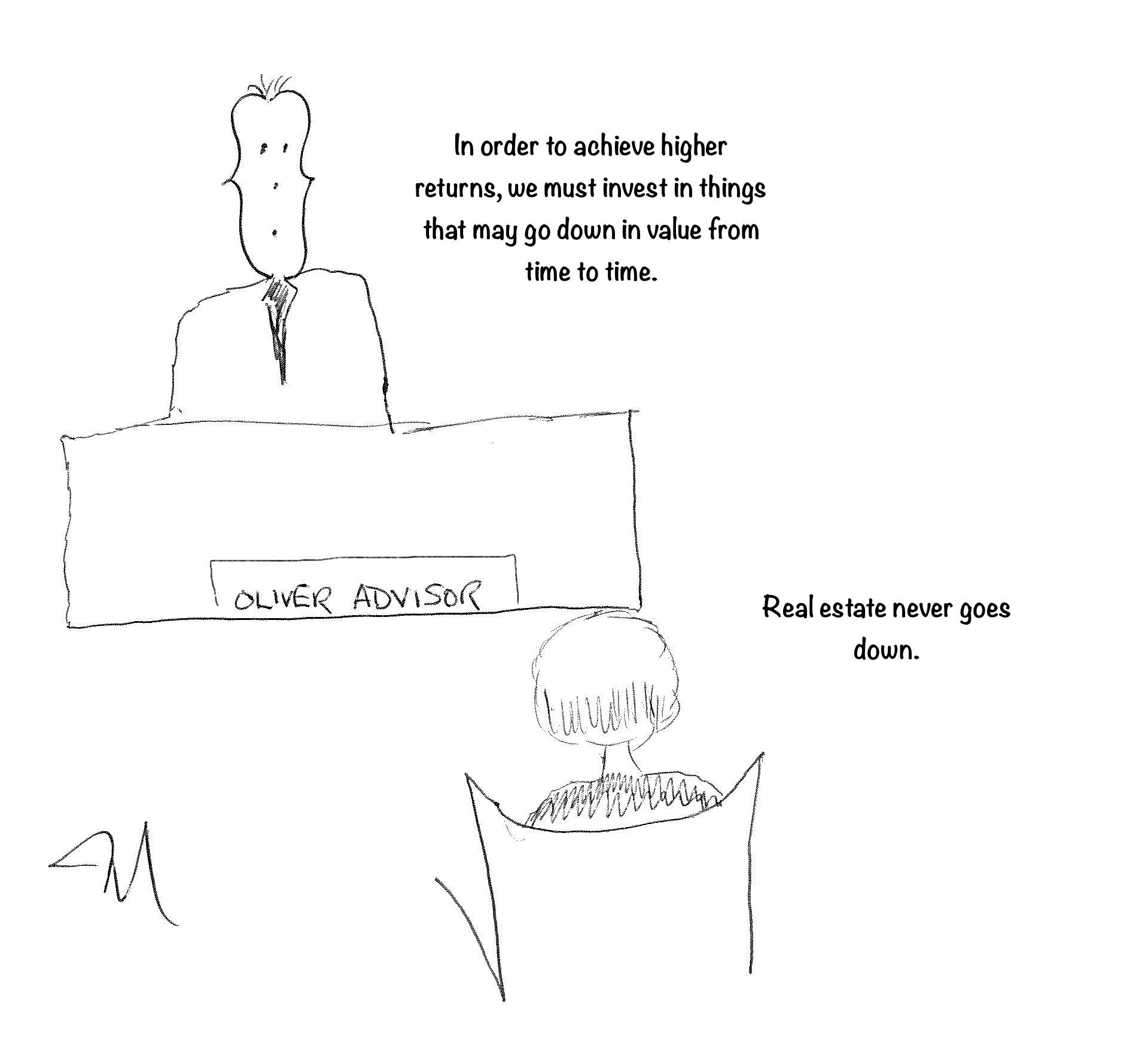

I for one, am not surprised by that this trend hasn’t emerged, as I haven’t seen this trend unfold within my own client base. Nonetheless, clients are often having discussions with me about their homes. Once people move past the decision to retire, the next big thing on their mind is what they should do about their house. For most of us, it is a big portion of our wealth, so my clients always look to me to help formulate what I’d call a business case around what to do.

Here are a few of the things that we’ve talked about recently.

“This place is badly in need of an update. We don’t know if it’s worth dumping money into it or just buying something that is already up to date”.

“I like living here. I’d rather not be in a condo or apartment. But I don’t have the energy needed to keep up with it”.

“As we get older, the idea of spending a lot on maintenance becomes a tougher decision. A new furnace and air conditioner or new windows are a big outlay. I know it’s morbid of us to think so, but why are we spending this much so late in our lives?”

While every situation is unique, I’ve developed a framework for helping clients deal with these questions. There is an aspect that is financial. The person who wants to stay in her house but feels she or can’t keep up with cleaning, gardening and snow removal might find a solution in paying others to do it and making it part of her budget and financial plan.

Just as often though, the key considerations are emotional, and we work to find a solution that feels right or identifies the psychological barriers. For example, with one client, we figured out that it wasn’t so much that she didn’t want to move. It was the idea of sorting through years of stuff and deciding what to do with it that was overwhelming.

These kinds of conversations are coming up more and more often. I’m not sure if we’ll see the wave of selling at some point down the road. But decisions around the family home are moving more to the forefront for seniors and their advisors.

Are decisions about your home a concern? Are the implications financial and practical? Or are their emotional elements too?

If so, contact me for help and let’s chat about your options.