I listened to a podcast interview with one of my favourite people, Jerry Seinfeld. It was unlike any other I had seen or heard. He didn’t trace his history in show business or talk about how the idea for the most famous episodes came to life. Instead, he talked about his personal habits, his routine, and the creative process that he goes through. He said that he writes every day and maintains several other disciplines to support and nurture himself including exercise and Transcendental Meditation, which I too, also practice.

I found the whole thing fascinating. But there was one point that stood out to me, which was how he found value in failure. With his usual comedic flair, he said that he’s learned that pain is knowledge rushing to fill a void that was previously there. For example, if you didn’t know the bedpost was right near your foot, that knowledge is suddenly and quickly acquired.

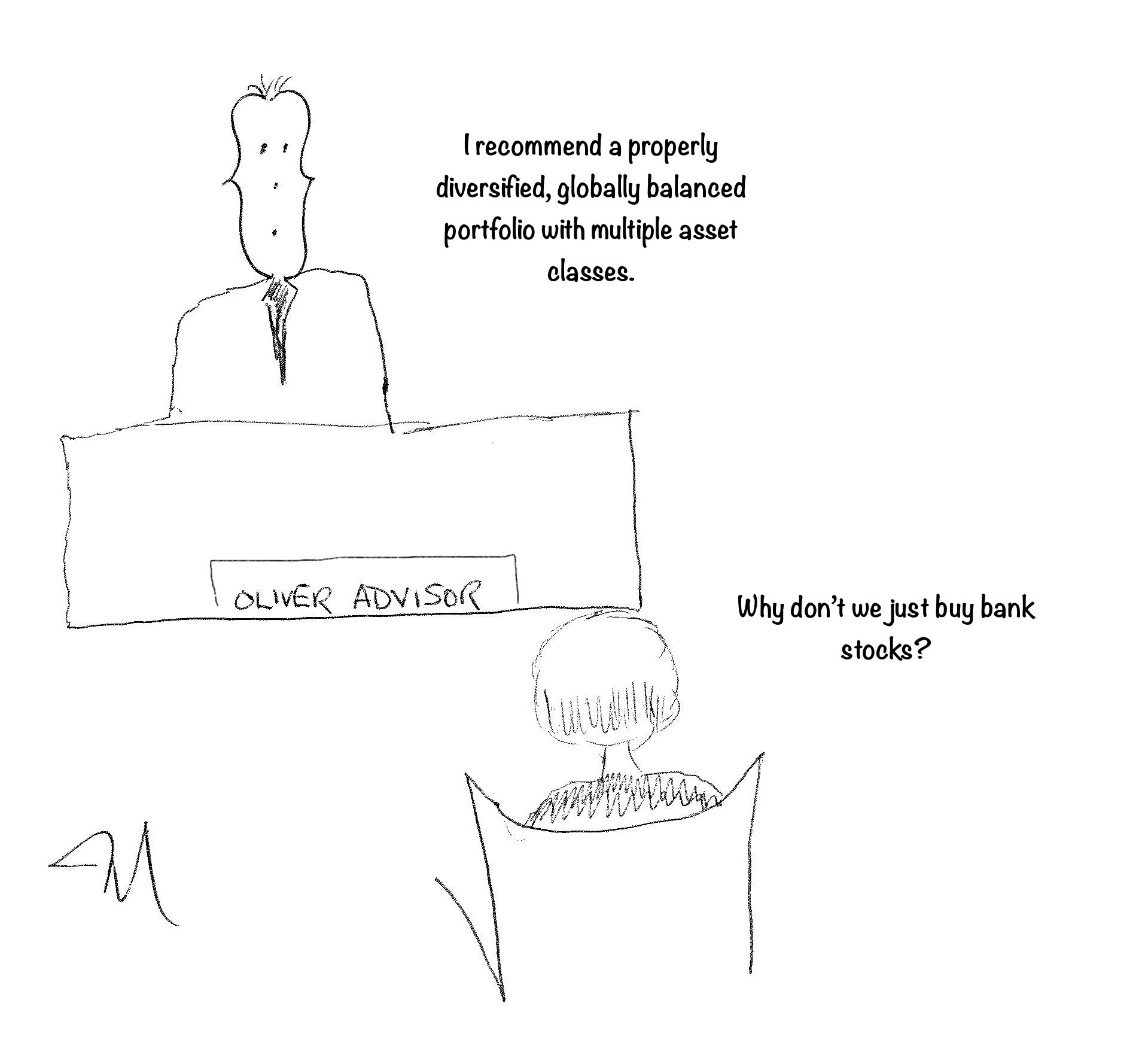

I realized that my job as an advisor is to try to ensure that clients don’t have one of these “sudden” and sometimes even painful learning experiences. That my job is to help them avoid and prevent the pain that comes with gaining a sudden understanding of something.

So, let’s look at the things you’d rather not learn the hard way;

- Putting too much money into a speculative investment can bring the pain of a sudden and permanent loss of capital.

Knowledge: the importance of prudence. This is why I diversify portfolios.

- Reacting to market turbulence instead of sticking with an investment strategy can lead to the pain of losses that are difficult to recover from.

Knowledge: the benefit of staying invested. This is why I make investment decisions based on a client’s plan rather than on markets.

- Not being properly diversified can bring the pain of unnecessary drops in a portfolio that take longer than they otherwise should to recover from.

Knowledge: the benefits of suitable asset allocation. This is why a portfolio has cash and bonds as well as stocks.

- Failing to plan properly prior to financial undertakings can lead to the pain of higher than necessary taxes and erosion of one’s wealth.

Knowledge: getting professional advice ahead of time. This why I form deep relationships with clients where they feel comfortable sharing life’s challenges and their plans with me.

- Failing to plan one’s estate can lead to pain among loved ones and beneficiaries. I guess in that case, one person learns from another’s mistakes.

This isn’t to say that you can avoid all discomfort. Watching your investments fall in value during lousy markets is expected, and to be honest, is quite uncomfortable. But with proper diversification and a solid investment strategy, it shouldn’t be painful.

Just as in our school days, there will be things that seem boring, obvious, no fun, and with no good reason to do them. Listening to me say that we should own some bonds when stock markets are flying high will likely seem as relevant as me pointing out “there’s a bedpost there”. But when the market has its inevitable correction, it will all become crystal clear; something learned over time instead of that sudden rush of knowledge that fills a void. That would be no laughing matter.

Now, we’ve all learned some hard lessons, myself included. And so, I must ask, what have you learned the hard way?