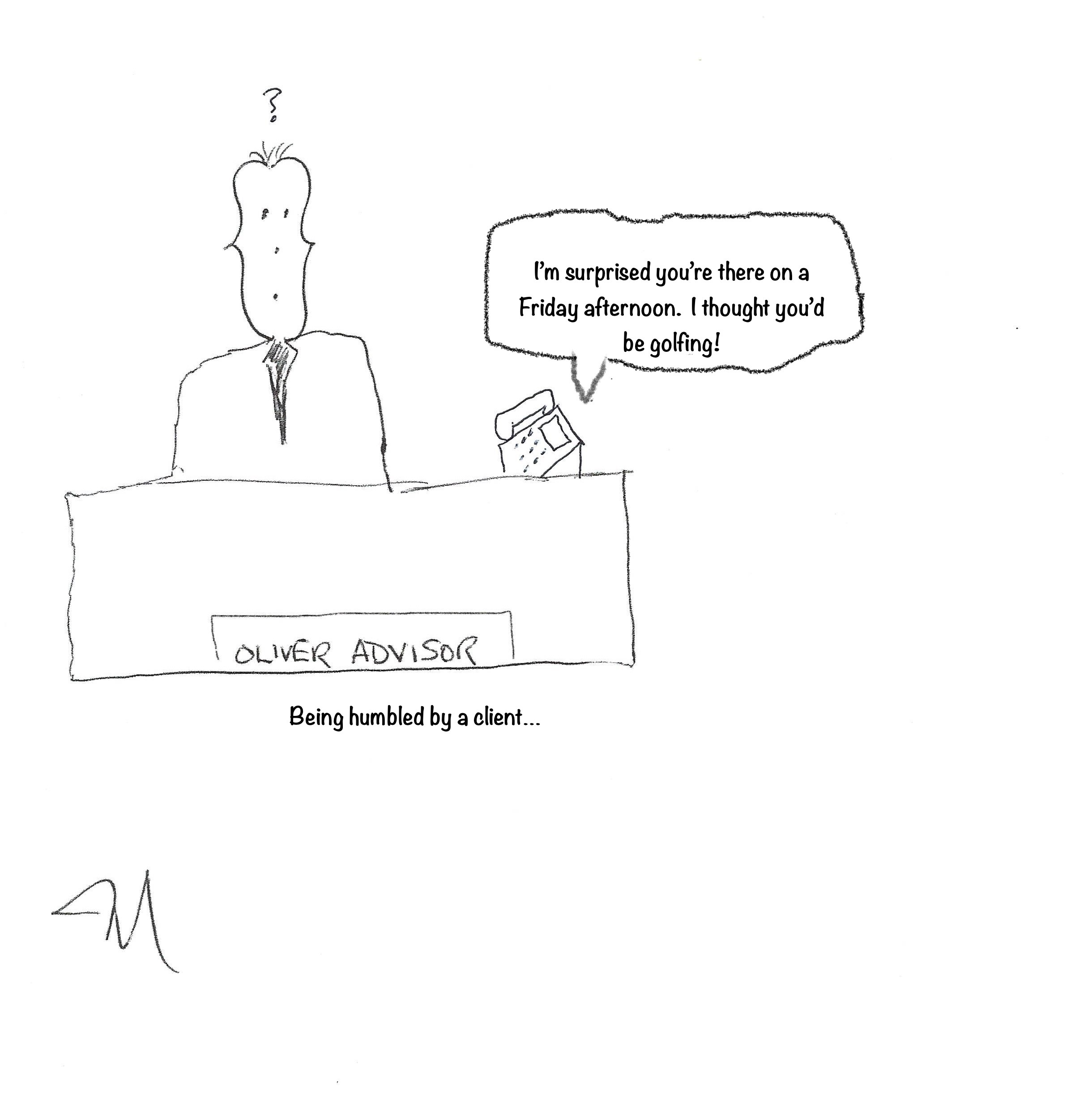

I have something to confess. I don’t have all the answers. You probably already knew that, but it gets us talking about what we expect from the professionals in our lives. I’ve often said that humility is the single most important attribute that an advisor can exhibit.

The great thing about humility is that it works together with confidence. It takes a certain amount of self-esteem to be truly humble. Humility isn’t downplaying your skill. Humility is understanding your limits and weaknesses and being ok with them such that it doesn’t affect your self-worth. When we are humble about what we don’t know and self-assured about what we do, we can be confident. When confidence is not warranted because we overestimate our abilities, that’s hubris.

So how does this relate to advice?

Well, the humble advisor never makes it about himself. He listens and puts clients’ interests first. He doesn’t need to prove to anyone that he’s smart because it doesn’t matter. All that matters is positive outcomes for his clients.

The humble advisor admits his mistakes. He’s willing to be vulnerable and to openly share how he’s constantly learning. He’ll tell stories about the times he was wrong and when he’s been humbled.

The humble advisor knows what he knows and what he doesn’t.

Here is what I know; what I can say with absolute conviction.

- Markets don’t go up and stay up forever. They don’t go down and stay down forever. Markets have gone up more often than they have gone down. And, they’ve gone up to a greater degree than the degree to which they have fallen. The odds have historically been in your favour.

- A properly structured and properly diversified portfolio will serve you well over the long term.

- Investor behaviour drives more outcomes than investment choices.

- Costs matter.

- I can add value – whether it’s by helping control behavior or by integrating comprehensive planning with investment management, I’ll make a difference that is well worth my cost.

Here is what I don’t know.

- The short-term direction of the market or a sector.

- What the next big thing is going to be.

- What will happen if something else happens. For example: if inflation rises, will gold go up? There are many correlations, yes. But I’ve been surprised many times by what should have happened and didn’t. The important thing is that it shouldn’t matter to you or your money one way or another if you’ve planned and structured your portfolio properly.

I’ve learned that doing the things I know well makes a big difference and creates positive outcomes. I also learned that when I don’t try to figure out the things I don’t know, there is no great missed opportunity. But if it had tried to figure them out and failed, the outcome would be very bad.

I’m grateful for the humility to let go of what I am not able to know and the conviction to stick to what I do. When I do, the outcome will be positive. I can say that with confidence.