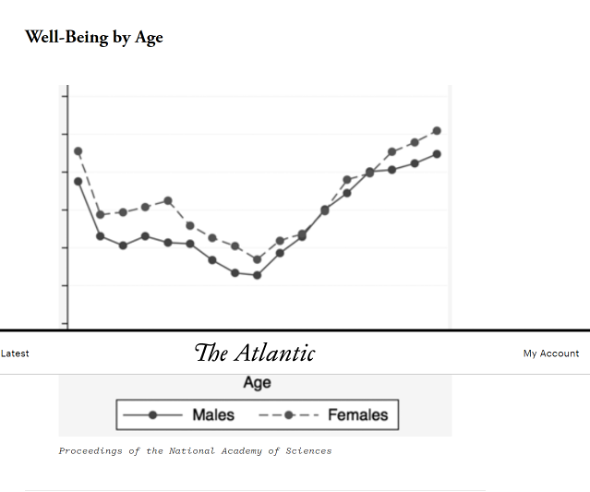

Research has produced something known as the Happiness Curve which measures our level of contentment at different ages. Based on my age, I should be at the lowest point of my life. Yikes! Happiness is relatively high from our twenties through our forties, but bottoms around age 55. It begins to increase again in one’s 60 and 70’s.

That is certainly cause for reflection. The thing I find most interesting is that we are generally gaining financial strength by our mid fifties. By then, most of us have more money than we’ve ever had. Our incomes are higher, our debts lower and our investments have accumulated. It’s when people put major expenses like home buying and educating children behind them and start to look ahead to the next big milestone – retirement.

So why the long faces?

As a wealth management professional, that makes me ask if we are adequately connecting our money to our happiness. I’m definitely not saying that money can buy happiness. I’ve written about that before. But an increase in our net worth should be wind at our back and give us one less thing to worry about.

Portfolio Managers track investment performance using benchmarks. If they’re trying to measure whether they’ve done a good job in selecting Canadian stocks, they’ll compare their return in that area to the return of the TSX. In recent years, wealth managers have taken to measuring the performance of clients’ overall portfolios in relation to their goals and their financial plan. It matters less, they would say, to beat a stock index than it does to be on track with your plan. They call it goals-based reporting.

But maybe we need to track it even more differently than that. Maybe our wealth benchmarks need to evolve, even if perhaps they are less empirical (numbers-based). If happiness and fulfillment are our ultimate goals, we shouldn’t be asking “did I beat the index?”, we should be asking questions like this:

- What is most important to me in life? Is my wealth supporting that?

- Do I feel like my wealth can help me move forward to where I want to be next in life?

- Is my wealth a source of security? Does it help me sleep better or does it cause me worry?

- Does my wealth make me feel better about myself? It is a reflection of who I am or who I want to be?

I’ve heard it said that if you want to see where a person’s priorities lie, look at their calendar. But shouldn’t our bank statement tell something about that too? If we ask ourselves “what is most important to me in life? From what do I derive the most peace, contentment, and fulfillment?”, shouldn’t our money be focused, at least in part, on achieving those things?

I’m sure there are a lot of things that contribute to this low point for middle-aged people. Money may be among them but is probably not the biggest contributing factor. In my dealings with clients, it’s usually the elderly who resist using their money to make life easier. People invest all their lives to have money “in case they need it” and are then reticent to put it to use for those purposes. As people age and they struggle to maintain their home or can no longer drive, they avoid using their money to pay someone to help with these things when it could make their life so much easier.

Let’s not build wealth for the sake of building wealth. Let’s build it for it can do for us and for others too. It should always be closely aligned with our priorities, our values, and what brings us happiness and fulfillment.