In a recent blog, I talked about whether you should consider giving your heirs some of their inheritance in your lifetime rather than having them wait until you die to receive everything from you.

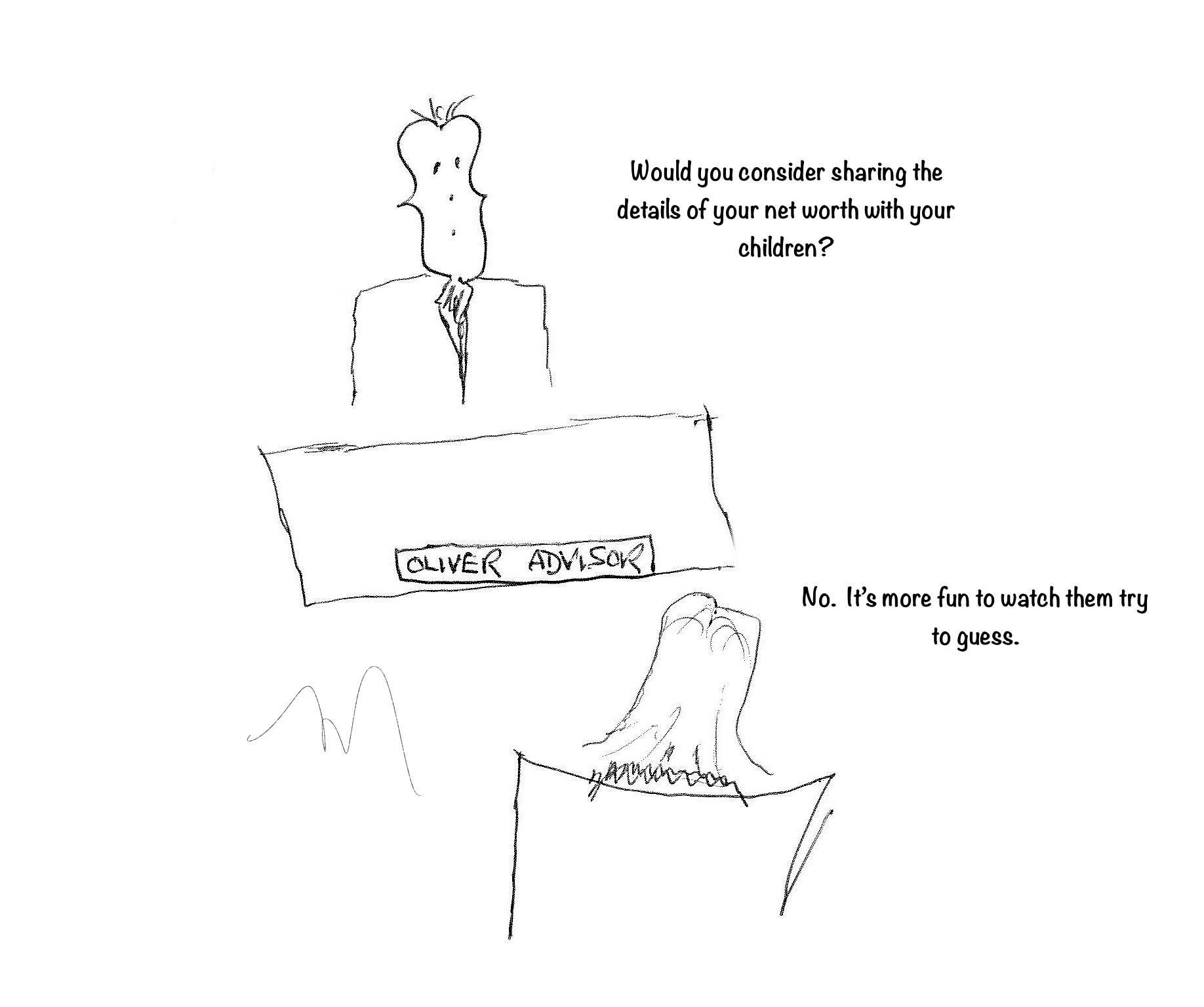

If people decide to do this, their heirs, usually their children, will gain some insight into the extent of the giver’s wealth. This raises the question, do your children know what you’re worth? And, how much do you want them to know?

Some of my clients include their children in our meetings, usually because they are getting older and they appreciate the assistance in processing the information I provide and the support of the children in making financial decisions. But most often, families are not very forthcoming with their children about how much money they have. Let’s consider the pros and cons of doing this.

Pros

There are no secrets and no surprises. Sometimes, your heirs think you have more than you actually do and they are counting on receiving it one day. This sheds light on the situation and gets them to start making other plans sooner. Other times, the family is unaware of commitments that were made such as amounts that were loaned or charities to whom you intend to give.

You have an opportunity to make your values around money clear and to pass on those values. You can talk about how you approached money and what you got you to where you are today. You can share stories about how you found a balance between living for today and planning for the future. You can also humbly share your regrets about choices you wish you’d made differently. Those things stick with people more than you’d imagine and they are powerful. Sharing your experience and your wisdom is a a gift to the people you love.

You can talk openly about inequities and family dynamics. A mentor once said to me that equitable does not necessarily mean equal. Sometimes provisions need to be made for family members with greater needs. It’s better to get that out into the open and for other stakeholders to support it.

Cons

It might affect their motivation. Depending on the amount you have and the attitudes of those who would receive it, it could make them less inclined to optimize their efforts to build their own nest egg.

It could cause resentment. Again, depending on their attitudes, it might make them think things such as “why don’t you give me some?” or “why did you give my sister money for x when you could have given it to me for y?”

I could exacerbate problems that already exist. Like I’ve said before, most people’s money problems are not really about money.

Think about your situation. If the pros outweigh the cons, it’s clear you should have an open discussion amongst your family. If the cons carry more weight, it doesn’t mean that you should not have the discussion. You need to ask yourself if it will be better or worse if it all comes out when you’re gone. You might think that it’s better if you’re not around to see it. But ask yourself if that’s what you really want. A few tough conversations now might afford the opportunity to avoid problems later. Chances are, you’ll rest in peace as much in your lifetime and as you will after it.